Product Design - Case Study

manage your business finances digitally - Hisaab

manage your business finances digitally - Hisaab

About Hisaab

The Arabic word ﺣِﺴَﺎﺏ means bill. Its a mobile app to manage finances of your business all in one place.

MY role

I worked as a founding designer and worked on it from research till production.

What was the actual problem ?

Small and medium-sized enterprises (SMEs) form the backbone of many economies, especially in countries like Pakistan. These businesses often rely on manual, paper-based methods for managing their transactions, credits, and debts. This traditional approach leads to various inefficiencies and challenges that hinder the growth and smooth operation of these businesses.

Gathering the insights from the shop owners

Key problems I found while interviewing the shop owners

- Manual Record-Keeping: Traditional pen-and-paper methods are time-consuming and susceptible to human error.

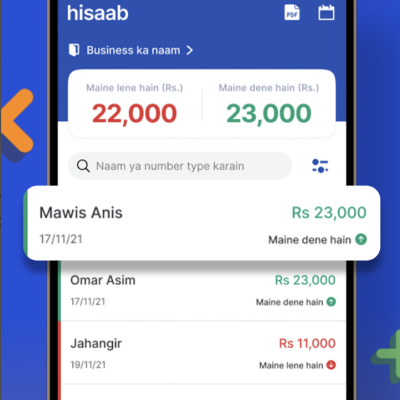

- Payment Tracking: Difficulty in keeping track of who owes money and who needs to be paid, leading to cash flow problems.

- Payment Reminders: Inefficiency in reminding customers about their dues, often resulting in delayed payments and strained customer relationships.

- Financial Reporting: Lack of easy-to-generate reports that provide insights into the business’s financial performance.

- Data Security: Risk of losing critical financial data due to the non-digital nature of record-keeping.

- Accessibility: Limited access to financial records, which are often stored in physical ledgers that are not easily accessible on the go.

Business / Design Challenges faced during research and launch

We were a bit skeptical about following challenges

- User Adoption: Convincing traditional business owners to switch from manual bookkeeping to a digital platform.

- User Education: Ensuring that users understand how to use the app effectively, especially those with limited technological skills.

- Localization: Adapting the app to cater to diverse languages and regional accounting practices.

- Data Security: Implementing robust security measures to protect sensitive financial data.

- Scalability: Ensuring the app can handle a growing number of users and large volumes of transaction data.

- Internet Connectivity: Making the app usable in areas with poor or intermittent internet connectivity.

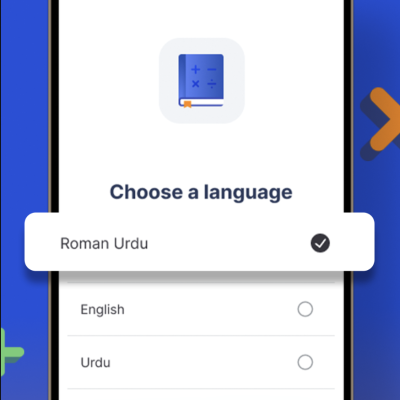

Localization

- To cater the needs of a diverse market, we introduced the application in multiple languages

- • English

- • Urdu

- • Roman Urdu

- • Arabic

Free Whatsapp / SMS Reminders

- Business were able to send free SMS or whatsapp message to the customers and we introduce the feature to automate the reminder and business could specify the interval date as well.

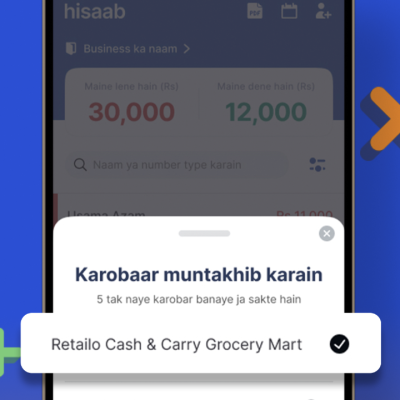

Multiple Ledgers Option

- One of the issues were if any business owner was maintaining multiple then what could be the solution?

- We introduced option to have multiple ledgers which can be switched easily.

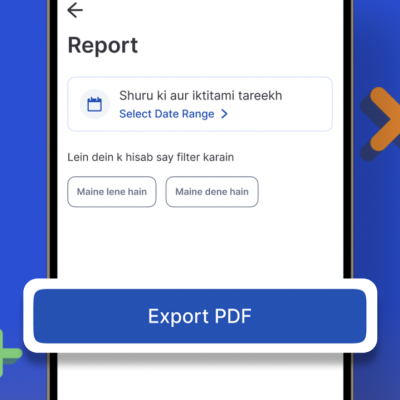

Reporting Options

- The option to export reports based on timeline was a game changer for the businesses because with manual ledgers they had to do closing after a certain period to do all the calculations but the app did it with in seconds.

Impact & Conclusion

- Increased Efficiency: Saves time by digitizing transaction records.

- Improved Cash Flow: Faster customer payments through automated reminders.

- Real-Time Financial Insights: Provides instant access to sales and expense reports.

- Enhanced Customer Relationships: Professional and timely payment communications.

- Convenience: Manage finances anytime, anywhere with mobile access.

- Data Security: Secure cloud backup prevents data loss.